International arbitration in 2025

Arbitration as a tool for private capital disputes

By John Choong, Oliver Marsden, Patrick Schroeder, Samantha Tan, Thomas Walsh and Niklas Wong

In brief

We anticipate an increase in disputes arising from deals in the private capital space. The significant backlog of failed exits from deals signed in recent years is driving more investors to arbitration to resolve -related disputes. Additionally, the growth of "secondaries" as alternatives to traditional M&A and IPO exits is leading to a new class of disputes. Arbitration remains the preferred tool for private capital institutions to resolve post-M&A disputes. Private capital investors are also increasingly leveraging arbitration against state governments under investment treaties to address adverse legislative, regulatory or other actions taken by host governments.

Title

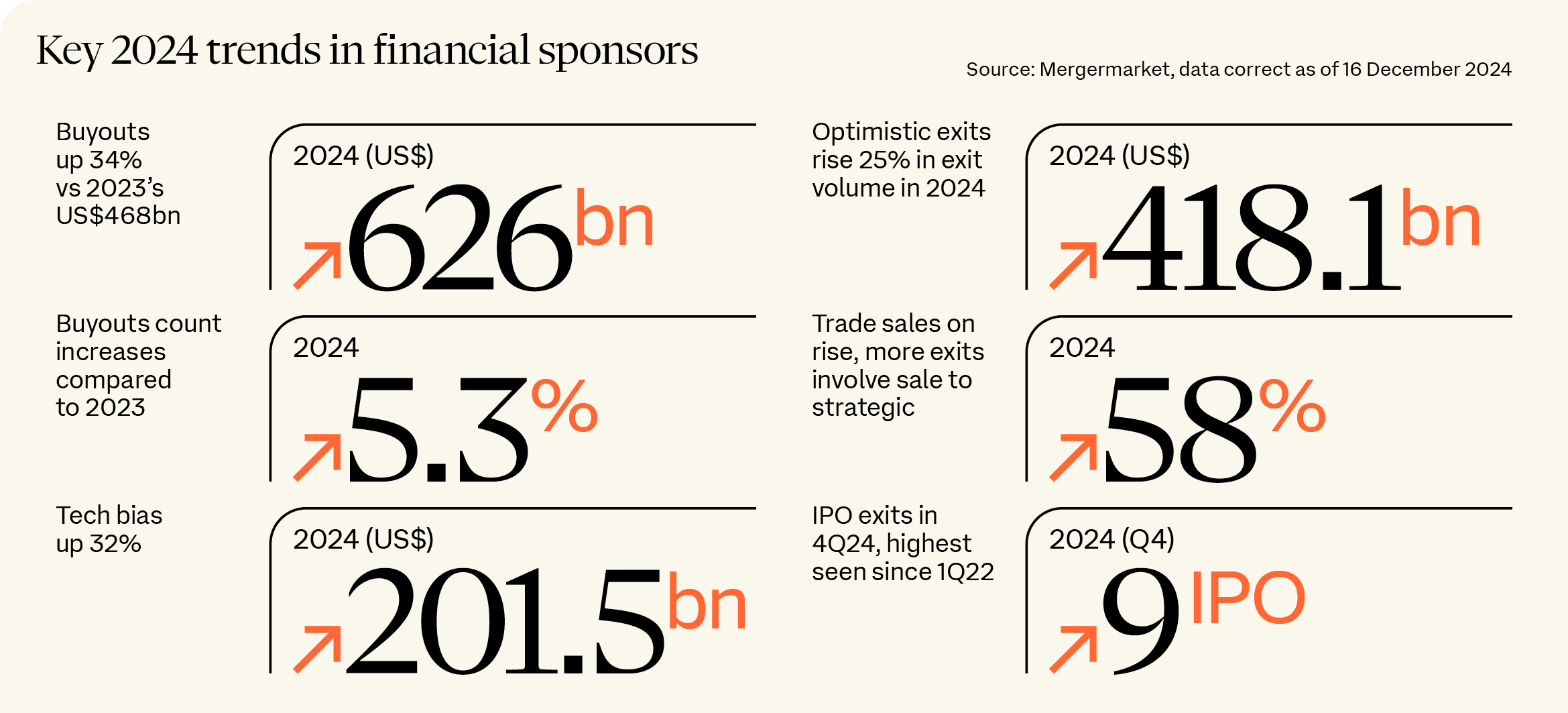

Increased deal-making: optimism meets uncertainty

The macroeconomic outlook for 2025 is cautiously optimistic for dealmakers, tempered by ongoing uncertainty and volatility. With inflation largely coming under control and interest rates trending downwards, market sentiment is increasingly positive, fueling greater interest in deal-making. Financial sponsors, holding trillions of US dollars in dry powder and under pressure to strike deals, along with high US-listed public asset valuations, are expected to drive continued interest in alternative assets from institutional and sovereign wealth funds. As Freshfields’ Co-Head of US Corporate and M&A, Ethan Klingsberg, observes in his M&A Predictions and Guidance for 2025, fund-level transactions in expanding secondary markets are here to stay in 2025. Private credit is also not going away, as investors seek additional avenues to enhance returns in a lower interest rate environment. Of course, it remains to be seen how the tide may turn with the new administration in the US.

Disputes between signing and closing

Disputes continue to arise between signing and closing transactions due to failures to fulfill conditions precedent to closing such as necessary regulatory clearances from antitrust or foreign investment authorities. These disputes often stem from delays caused by the authorities or from onerous requests made during the clearance process. In some cases, buyers responsible for obtaining regulatory clearance but facing post-signing remorse – due to shifting interest rates or other changes in market or business conditions – may attempt to engineer a failure to obtain regulatory clearance by a long-stop date (i.e. to time-out the condition precedent) so that they may abort the transaction. In these situations, the seller may have a claim for breach of the buyer’s efforts-related obligation (e.g. to use “commercially reasonable endeavors”) to fulfill the relevant condition precedent.

Deal-related disputes

In 2024, we saw an increase in claims based on alleged breaches of representations and warranties, either brought against the sellers directly or under W&I insurance (also known as RWI) policies. Other disputes arose from fundamental issues with the target company, which had either been overlooked during the due diligence process or surfaced post-acquisition. This trend is expected to persist in 2025. The growth of “secondaries” – transactions in which one investor divests an interest in a fund or sells a portfolio company or other asset to another investor – is also leading to more disputes arising from those transactions.

The growing use of earn-outs to bridge valuation gaps between buyers and sellers will remain a key source of disputes. Earn-outs are inherently contentious mechanisms. Valuation issues and the time gap between signing and earn-out triggers naturally carry the risk of disagreement between the parties. Disputes typically arise over the interpretation and construction of bespoke earn-out clauses, especially when sudden market or business changes occur. Disagreements often center on whether the criteria triggering the earn-out were genuinely met or artificially achieved. As we have analyzed in the past, this underscores the need to establish clear and objective criteria, and careful consideration of how targets may be manipulated when structuring such provisions.

Other pricing mechanisms, such as locked-box arrangements and closing accounts adjustments, which often include covenants and indemnities, have also led to similar disputes.

In many cases, parties pursue post-closing claims through arbitration to leverage a settlement that effectively adjusts the purchase price to reflect the impact of the underlying issue.

Exit disputes

Stretched valuations and portfolio company underperformance – particularly in deals predicated on lower interest rates or different business models, such as those seen during COVID-19 – as well as broader market headwinds, have made it difficult to achieve liquidity events at target prices. Currently, a significant exit backlog remains, with sponsors estimated to hold globally over US$3tn of unsold assets in their portfolios at the end of 2024. This prolonged holding period has led private capital institutions to become involved in a greater number of legal proceedings with their portfolio companies and their commercial counterparties.

Additionally, we have seen a notable increase in JV disputes, particularly in minority investments, driven by failed exit rights, such as put options or conversion or redemption rights. Investors are facing difficult decisions about the viability of exercising these rights, especially when portfolio companies and their founders have insufficient funds to meet their obligations.

Other exit-rights disputes have turned more heavily on factual matters, including allegations of mutual breach, collateral agreements, waivers, and lack of regulatory approvals, such as those related to cross-border currency controls. In some cases, these arguments are aimed at engineering a restructuring of the deal or a reduction in the previously agreed exit price.

Investment treaties as leverage

Private capital investors are increasingly looking to arbitration under investment treaties as a response to adverse government actions and regulations. These treaties, between the country of incorporation of the foreign investor’s investment vehicle and the country in which their investment is made, offer significant leverage to foreign investors. In some cases, governments have rolled back legislation following investor-state arbitration claims threatened or actually brought by foreign investors. A widely cited example is India’s decision to scrap the retrospective imposition of capital gains tax on transactions involving the indirect transfer of Indian assets, following billion-dollar arbitration claims by foreign investors like Vodafone and Cairn Energy.

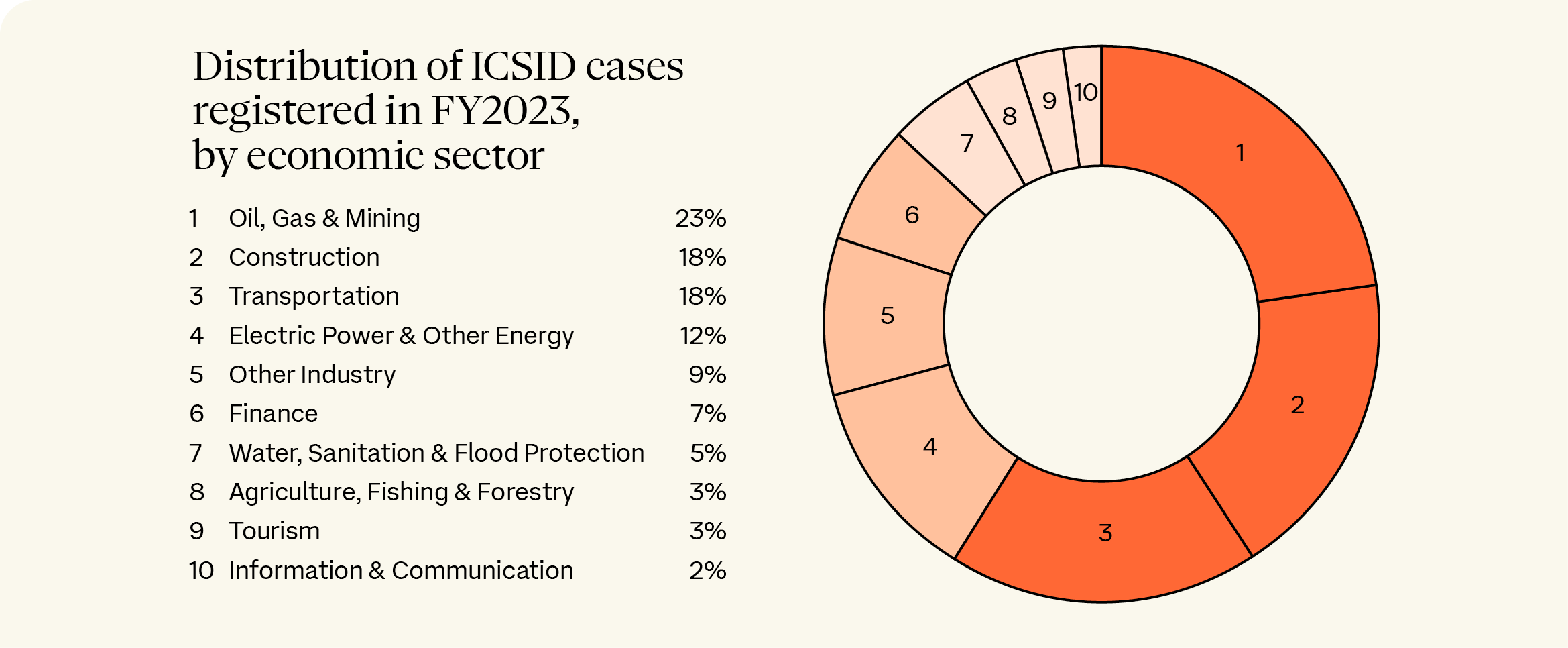

While traditional and renewable energy companies, mining and infrastructure companies, are frequent users of investment treaty arbitration, we are also seeing private capital investors in sectors like real estate, telecommunications, transportation and finance take an interest in investment treaty protections. The World Bank’s ICSID Caseload Statistics highlight the diverse sectors in which investment treaty arbitrations have arisen under the auspices of ICSID:

Private capital investors across multiple sectors have increasingly turned to investment treaty arbitration to protect their investments. Examples include Spain’s reduction of feed-in tariffs for wind and solar energy investors; plans to enact more restrictive regulations in the pharmaceutical sector across several countries; and allegations of governmental corruption influencing a pension fund’s vote on a public M&A transaction in Italy.

As governmental actions adversely affecting major corporations continue to rise, ICSID registered its second-highest number of new cases in FY2024. Private capital investors should consider investment treaty arbitration as a key tool in their legal arsenal for 2025 and beyond.

Looking ahead

Arbitration remains a leading dispute resolution forum for private capital disputes. Arbitrations are frequently subject to terms of confidentiality, which minimizes the risk of negative publicity from disputes. Party autonomy in arbitration also affords greater control over procedure and timelines compared to court proceedings in many jurisdictions and the lack of appeal rights on the merits in arbitration enables parties to get to a final resolution more quickly, which is crucial for funds with short exit timeframes. Investors also value arbitration’s ability to allow them to select decision-makers with relevant expertise.

Many private capital disputes are highly fact-sensitive. Therefore, from the outset of any potentially contentious matter, it is crucial for parties to handle written documents carefully, ensuring that a proper paper trail is put in place to support their factual position in future proceedings.

When structuring new transactions, investors should consider the availability of investment treaty protections based on the investment vehicle’s country of incorporation and the host country of the target company. These protections can offer an additional layer of security, depending on the region, nature of the investment, and industry sector.

Additionally, investors should seek to ensure that they have effective recourse for any claim, either through security (e.g., a tranched payment structure for the purchase consideration, or using an escrow mechanism), or available assets for enforcement in countries party to the New York Convention (the convention governing the cross-border enforcement of arbitral awards).

Our arbitration specialists have extensive experience in advising private capital clients on their disputes all over the world. Reach out to us to discuss the latest trends and their potential impact on your business.

- Introduction

- 1. AI in international arbitration: a fast-evolving landscape

- 2. Geopolitical shifts: new political agendas driving investment treaty claims

- 3. Russian disputes and anti-suit injunctions: arbitration and state courts - allies, adversaries, or both?

- 4. Investor-state mediation: a bridge over troubled waters?

- 5. Human rights and social issues in investment treaty arbitration: a growing trend

- 6. Arbitration as a tool for private capital disputes

- 7. Arbitration of space disputes: time for take-off

- 8. Game-changing sports disputes: a new normal

- 9. Privilege in arbitration – should one set of rules apply?

- 10. The shift from EPC to EPCM: a recipe for more complex arbitrations?

- 11. The internationalization of arbitration in Brazil: a rising trend

- 12. Shifting sands: the Middle East’s evolution into an arbitration hub