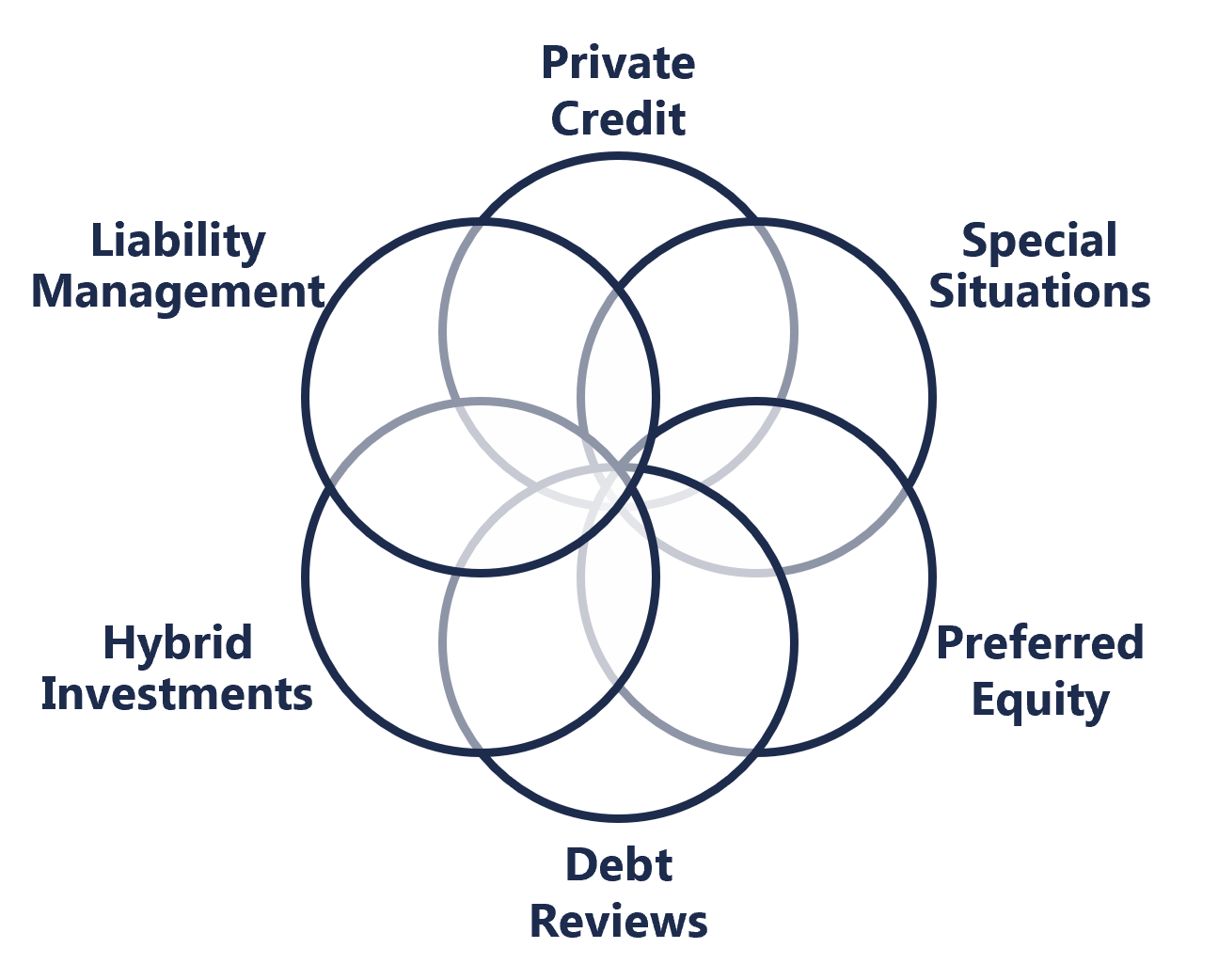

Whether it’s guiding a bespoke debt origination for a difficult-to-underwrite borrower, supporting a traditional acquisition financing through a combination of loans and preferred equity or investing in a hybrid debt and equity instrument, our first-in-class team of private credit and capital solutions lawyers provide fully integrated multidisciplinary advice for our private capital clients.

In addition to assisting in direct or primary financings, we are trusted advisors to many of our more opportunistic clients in identifying and evaluating opportunities in existing capital structures to put capital to work in creative and yield enhancing ways, including backstopping and financing liability management transactions. These same clients also frequently rely on us to shadow designated “arrangers” counsel or assist them in complex intercreditor negotiations to ensure proper minority rights in club deals with other private credit providers.